It is a Rapid Design Thinking exercise which will help us to understand the methodology at a larger scale. It’s a great way to view our processes and see how we would tackle given problems.

What I have done:

User Research, UX strategy, Interaction Design, Prototyping, User Testing, UI Design.

Tools:

Pen & Paper, Sketch, Invision, Photoshop

Sector:

Social Networking

I remember when I first used an ATM. It was my mid-school years when I was around thirteen years old. I went to the bank with my dad and opened a savings account, and instead of giving me an ATM card, they handed me a piggy bank! I questioned this process and became very disillusioned. Why did anyone bother opening a formal bank account if that’s all we received for our troubles?

When it comes to kids opening a bank account and using an ATM, there’s always the question of why, and is it necessary? In retrospect, these questions start with the adult process of empathy. So, let’s start.

Empathy

What is an ATM and what it is used for?

An automated teller machine (ATM) is an electronic banking outlet that allows customers to complete basic transactions without the aid of a branch representative or teller. Anyone with a credit card or debit card can access most ATMs.

We need to understand the demographic or age group

when developing an ATM for kids.

The process of developing a kid’s ATM poses an ideal topic of investigative research. Our target age group is aimed at seven to thirteen-year-old kids. In my trial I used a controlled, test group of two kids — one being my daughter who is twelve, and the other is my son who’s seven. Some institutions don’t permit minors to have debit cards until they reach sixteen, but others

offer them to children who are thirteen or younger!

The process of developing a kid’s ATM poses an ideal topic of investigative research. Our target age group is aimed at seven to thirteen-year-old kids. In my trial I used a controlled, test group of two kids — one being my daughter who is twelve, and the other is my son who’s seven. Some institutions don’t permit minors to have debit cards until they reach sixteen, but others offer them to children who are thirteen or younger!

Questions presented to both my children:

What is an ATM?

My daughter: “It is the bank where you can withdraw money.”

My son: “You use your credit card and it gives you money.” (Actually, it’s very dangerous to withdraw from credit cards which effect credit scores — so I should teach my son!)

How and why would a child use an ATM?

My son and daughter gave similar responses.

They would save money, make payments to the school cafeteria (she owes $3.25 right now) and make withdrawals to buy goods and gifts. They also mentioned withdrawing their weekly allowances, making payments for club activities and covering Xbox membership. In short, it would take the constant pressure off adults having to ‘reason’ for kids — when kids are already learning instruments, doing homework, and creatively developing thinking strategies of their own!

Which screen features would a kid require to successfully use an ATM?

Firstly, a ‘Balance’ inquiry button to check balances and spend accordingly. It teaches kids about financial responsibility and prepares them for life — a vital educational benefit. Secondly, there’s the screen’s ‘Deposit’ button. For instance, the account holder’s grandmother might offer them $10 to make a deposit and start saving via the ATM. Monetary exchanges using the ‘Transfer’ button would see funds sent into the account holder’s savings account — a useful offering in the main screen.

The entire design would be safe, simple, and easy to navigate, using colorful symbols and icons. Height, shape and secure design of the ATM is an important consideration for youngsters.

Define the variables — Kids ATM

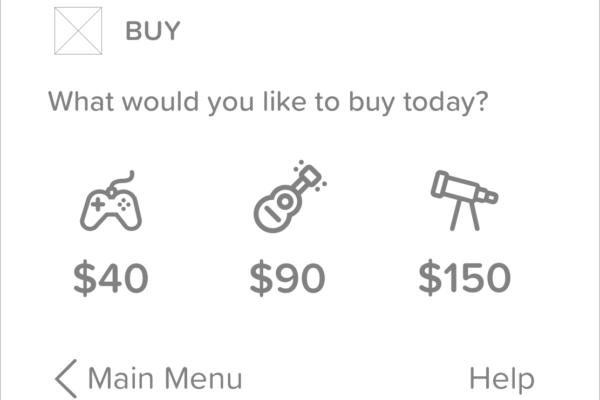

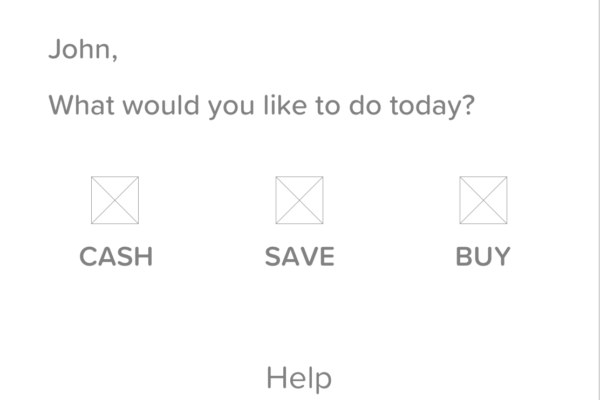

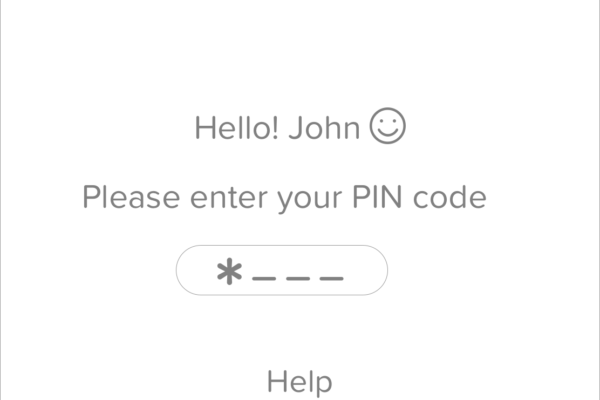

A Kids ATM should be user-friendly and simple. Usability would mean having large buttons, friendly icons, voice over prompts, and a ‘Help’ menu in a prominent location. Easy to navigate, kid-friendly visuals are the key.

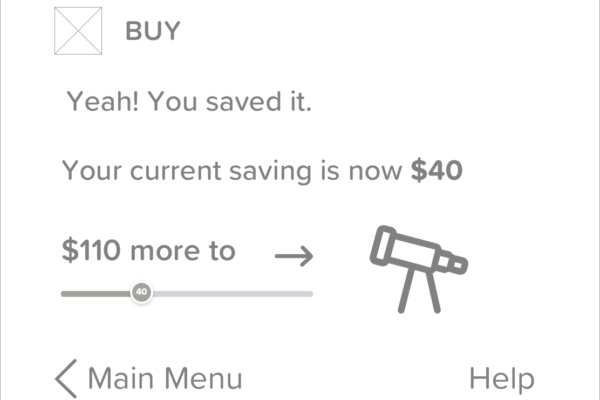

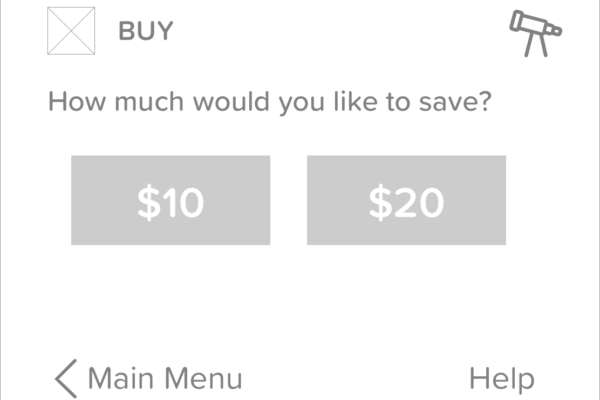

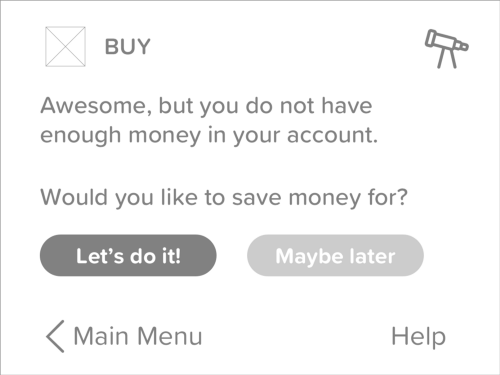

We would add gamification with basic accounting principles for kids. For example, information about interest rates would be displayed as a customized product. Prompts about saving money might help kids to save during their ATM experience. For example, at each ATM transaction, a screen prompt would appear: “Would you like to save money for this beautiful dress?” “Choose option ‘Yes’ and choose the ‘Amount’ you want to ‘Transfer’ to save the money to your virtual Piggy bank”.

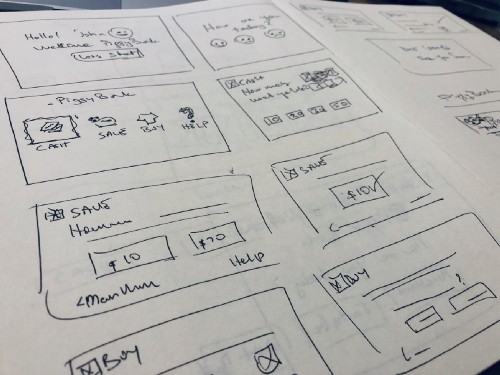

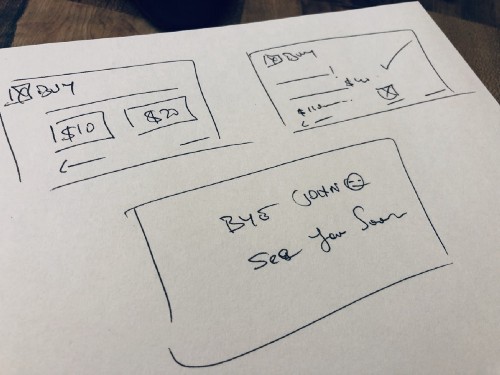

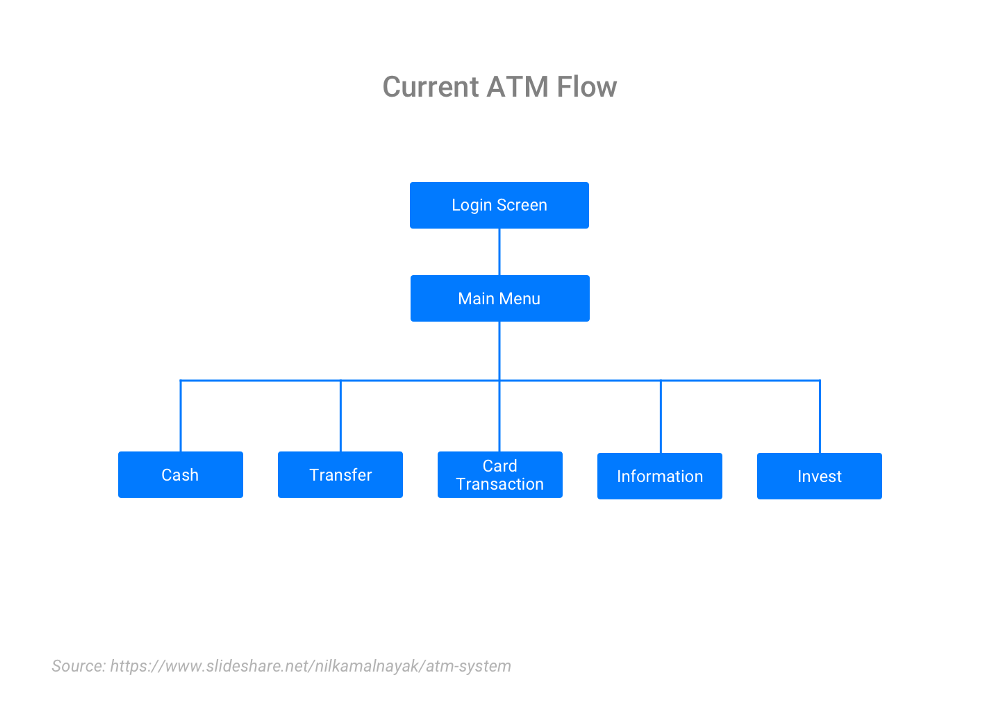

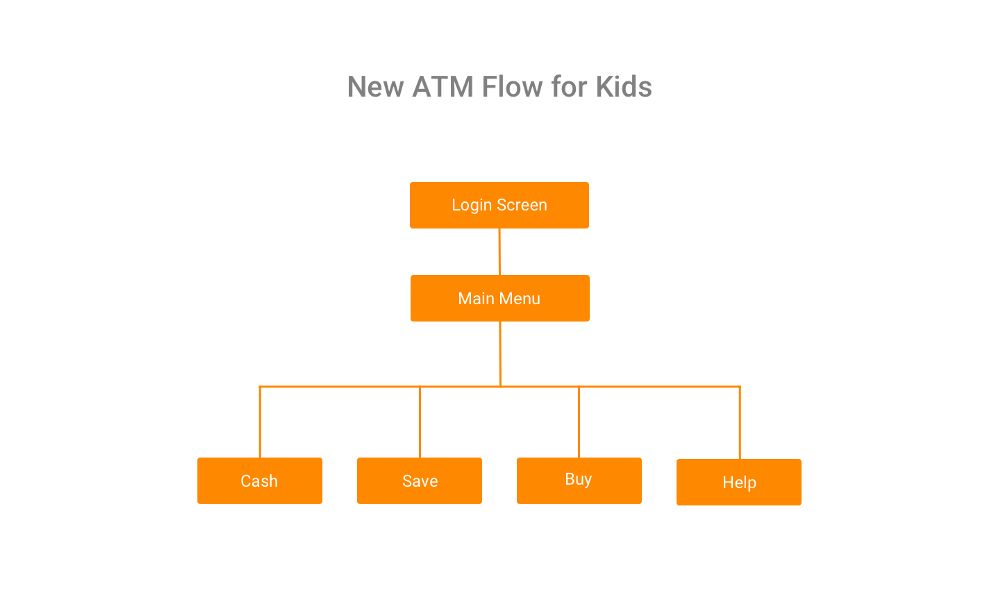

The new ATM Flow for Kids — simplified and easy to navigate:

Ideate

Here are some preliminary sketches and I have created.

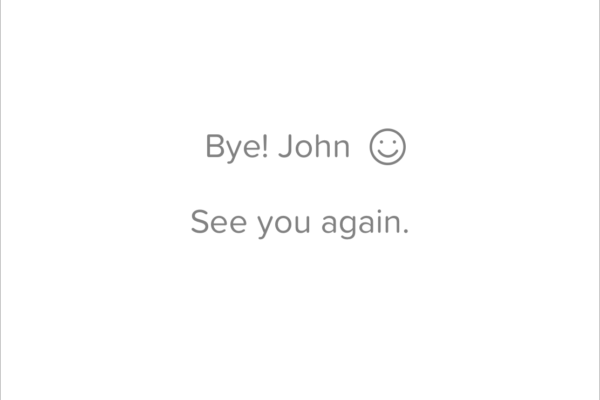

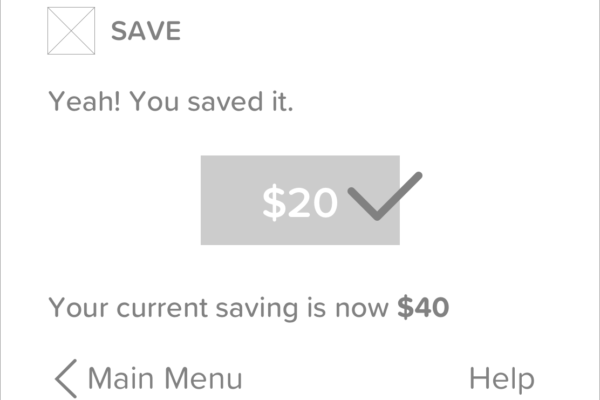

Prototype — Medium Fidelity

I’ve developed a medium fidelity prototype for the ATM, outlining the interactions and navigation right from the Welcome screen to the Main Menu. I’ve also added the gamified menu interaction to ‘Save Your Money’ as an educational tool or prompt feature. Kids then actively learn about basic accounting, budgeting, and financial planning while they’re out shopping at an impressionable age. Surely this benefits to parent and the community at large.

We aim to inspire and educate children with our prototype ATM while providing them with a sense of independence, contribution and social responsibility towards their community. The prototype has an added feature for donating charitable funds to help other needy kids in crisis.

Branding

I have created a brand called PiggBank and designed the logo.

I have also created a few high fidelity prototypes to show the concept.

Conclusion:

I’m proposing that test projects of this caliber or prototype be developed, manufactured and distributed by the banking industry, for the global purpose of educating our future generation. If we incorporate the curious ingenuity of a child, we can make significant gains for all young end-users.

Save your money kids!